Read the Original Article on Substack 👆

Modular Thesis

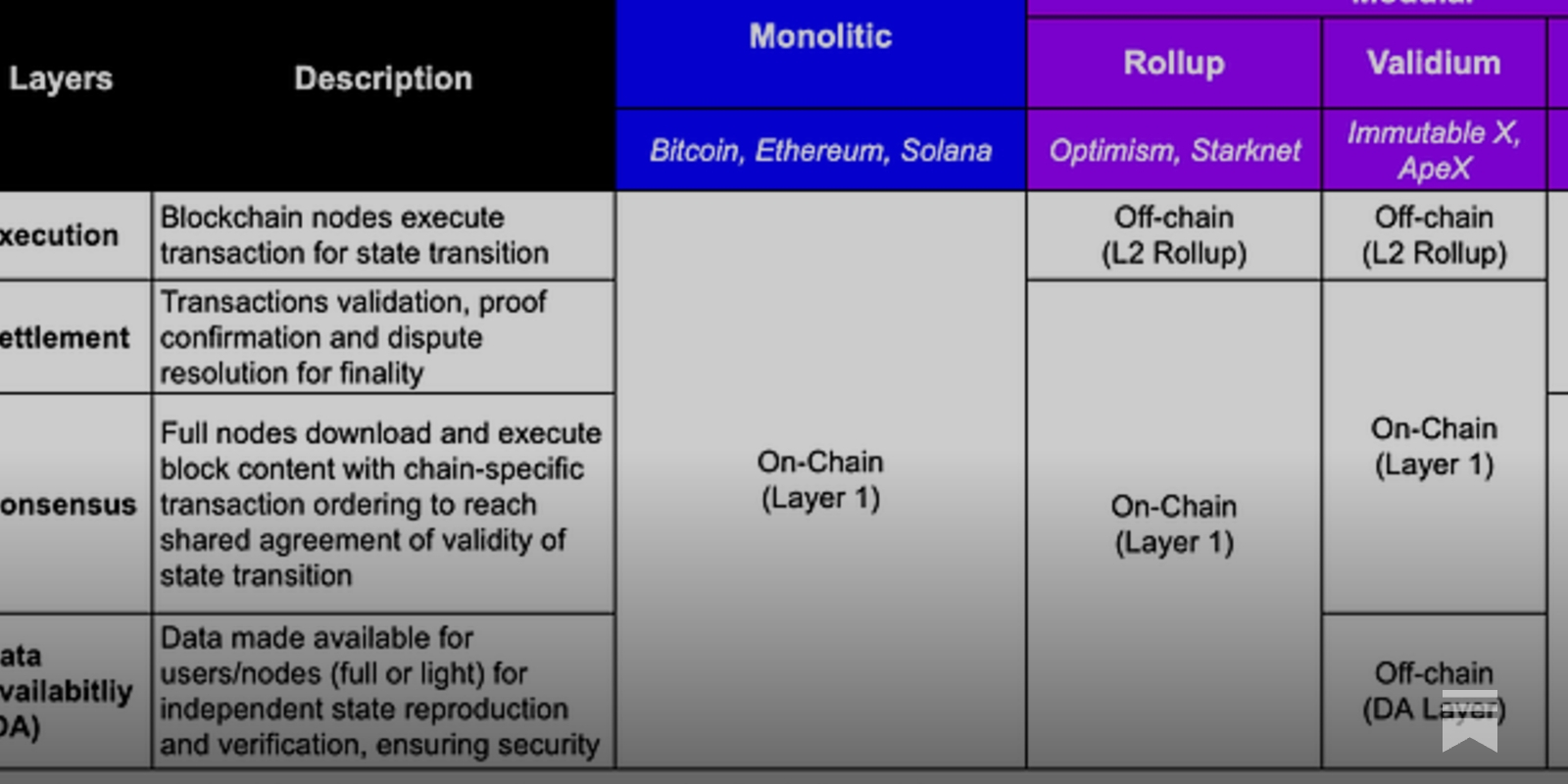

In extension of the kitchen analogy, in order to be a high output kitchen (network), we’d have to introduce this familiar concept of specialization of labor, or in this case, specialization of machine labor, as depicted in Charlie Chaplin’s Modern Times. Kitchens need to start grouping workers together and assign highly specialized tasks, while ensuring product transition between groups are smooth and safe. Enter Modular Blockchains (Figure 1), in which tasks originally performed by one single blockchain can be handled by highly specialized ones, segmented by layers. The goal is that these specialized blockchains perform their designated tasks well enough that the collective modular stack can scale better than a Monolithic chain while remaining decentralized. With such a framework, there comes a range of modular blockchain designs (Figure 1) that exhibits trade offs pertaining to particular use cases, giving greater customizability for Dapp developers depending on what they would want to optimize for (cost, speed, throughput, customizability, security etc).

In a modular setting, there are three broad categories of designs (Figure 1). Putting computation/execution off-chain, Rollup is the first category with Settlement, Consensus and Data Availability on-chain, effectively inheriting the security properties of the L1 it is anchored to. In addition to Execution/Computation Layer, Validium have the Data Availability Layer off-chain for extra throughput and cost reduction, usually having the semi-trusted and centralized Data Availability Committee (DAS) model and trustless and decentralized Data Sampling Model (DSM), which is pioneered by Celestia with light node sampling (horizontal scaling) instead of full node downloading all transaction data. The third category is Sovereign Rollup (Celestia), in which Execution and Settlement are both off-chain (hence sovereign) while Consensus and Data Availability are on-chain. It is important to note that even in a modular setup, the transaction lifecycle on a high level still remain the same as a Monolithic chain (Figure 2), with key differences in specific architectural designs of the modular components and particularly the connections, or cross-chain communication, between different modular blockchains in a transaction lifecycle. Note that in a Monolithic chain, since all layers are in one and tasks handled by more or less the same node types, there is no cross-chain communication within itself and hence less complexity.

Benefits

As mentioned sporadically in prior paragraphs, there are a great number of benefits to having modular blockchains. First, it enables greater throughput, speed and cost reduction. Zooming into how a Rollup functions, instead of a single transaction ingested on Layer 1, Rollup executes and batches transactions together, and then generates and passes a new state root along with the transaction batch to Layer 1 (in this case Ethereum) as a single transaction.

It effectively saves blockspace with transaction data bundle-up on the Layer 1, reducing original Layer 1 full nodes’ heavy workloads and data storage. In comparison to Ethereum’s 13 TPS, Rollups individually have high throughput - Arbitrum (~55 TPS), zkSync Era (~62 TPS), Base (~ 21 TPS), OP Mainnet (~10 TPS). From a transaction cost perspective, gas paid on an L2 is only a fraction of that of an L1 (Figure 1).

Another benefit of modular blockchains is great customizability and flexibility for Dapp developers. As mentioned prior, there are a range of modular blockchain designs that have trade offs for cost, speed, throughput, customizability, security, user experience and many more. Developers can choose the most suitable architectures like legos to optimize for their specific use cases. For instance, developers can consider Validum or Sovereign Rollups for gaming as it will incur large amounts of micro transactions, ultimately benefiting from fast transaction execution, lower cost (also from a data storage perspective as it is outsourced) and relatively lower security requirements. In addition, modular blockchains are easier to upgrade in a contained environment, reducing system failure and downtime.

Drawbacks

However, there are also noticeable drawbacks of modular blockchains. The first and foremost is fragmentation of liquidity and user experience. For instance, if users want to transact on Arbitrum while holding funds on Optimism, they will have to bridge the assets over before conducting the intended transaction. Second is security. Various modular blockchains that specialize in particular tasks (hence layers) in the transaction lifecycle (Figure 2) will have to communicate with each other asynchronously, which requires blockchain interoperability protocols to facilitate these communications. These interoperability systems are particularly hard to design with various models from trusted (federated) to trustless (light client), ultimately introducing new attack surfaces in a modular stack. From the rekt leaderboard, four out of the top 5 exploits are from blockchain interoperability protocols, totaling up to $2.15 billion lost. Finally, it introduces complexity in the overall system as mentioned with interoperability protocols and various modular blockchain designs.

Value capture

In the modular setting, the Settlement Layer is still the most valuable component within the modular stack as it is the final backdrop for transactions. It ensures the smooth and secure transfer of values and data between various parties. Without an efficient Settlement Layer, the whole stack would not be able to function. In addition, it also enables interoperability between different modular blockchains within the vertical stack, guaranteeing state validity on source chain and state inclusion on destination chain.

The next most valuable layer is the Execution Layer as it incepts transactions and guarantees that tasks performed by smart contracts are accurate and efficient, usually with automation. Such is also seen in Figure 5, which shows the fee percentage of distinct layers. Even starting in July 2022 where Optimism’s fee increases while Ethereum fees decrease, Ethereum fees still take up well over 95% in comparison to Optimism’s ~3% and Base’s 2%.

However, it is also important to note that the modular space is still quite new with most of the blockspace demand coming from Web3 native users (degens, web3 liquidity funds etc) and we have yet to see mass adoption from the real economy (web2, financial institutions) with many use cases unexplored. As more sustainable demand comes, Execution and Data Availability Layers value might increasingly accrue. Ultimately, various components in the modular stack can get commoditized, and such commoditization not only has to do with the quality of supply but also how inelastic the demand is. Just as in fashion, fast fashion with highly elastic demand is commoditized while haute couture is less so the case.

Conclusion

In summary, there is a lot of potential with modular blockchains across Layers (especially Execution and DA) despite some technical challenges. Its key benefits in scalability, cost reduction, customizability, flexibility, and ease of upgrade shall not be overlooked, especially in comparison with its Web2 counterpart. Its drawback on fragmented liquidity/UX, the need for interoperability and increasing attack surface are actively being solved with more sound blockchain interoperability systems being designed, particularly for the trustless light client relay type solutions such as Chainlink CCIP and LayerZero. In particular, there’s a relatively new class of interoperability solution called Coordination Protocols that sits on top of General Message Passage Protocols. It enables Dapps to directly deploy on top and handles state synchronization across heterogeneous modular blockchains while unifying liquidity and data flow. Lastly, as we are still in the early phase of blockchain adoption in general with various real world use cases unexplored, Execution and Data Availability Layers will likely have more value accrued over time (commoditization comes from a combination of demand and supply).

References

https://blockworks.co/news/monolithic-modular-blockchain-debate

https://shardeum.org/blog/modular-vs-monolithic-blockchains/

https://coinmarketcap.com/academy/article/modular-vs-monolithic-blockchains-what-s-the-difference

https://ethereum.org/en/developers/docs/data-availability/

https://dune.com/queries/520134

https://beaconscan.com/

https://www.quicknode.com/guides/infrastructure/node-setup/ethereum-full-node-vs-archive-node

https://explorer.solana.com/

https://solanabeach.io/validators

https://docs.solanalabs.com/operations/requirements

https://l2beat.com/scaling/summary

https://dune.com/queries/520134

https://l2beat.com/scaling/activity

https://dune.com/optimismfnd/optimism-l1-batch-submission-fees-security-costs